Not so long ago, we witnessed historical event in the world of cryptocurrencies, when the first company dealing mainly with digital currency trading, the Coinbase stock exchange, entered the US NASDAQ, where it offered its shares to the public.

Although the volatility of its stock price also approached the cryptocurrencies and shot up to $ 429 shortly after its listing, it did not last long and the price fell to a level approaching $ 200, where it found its lower limit. Current Coinbase shares are rising again, hovering around $ 261.

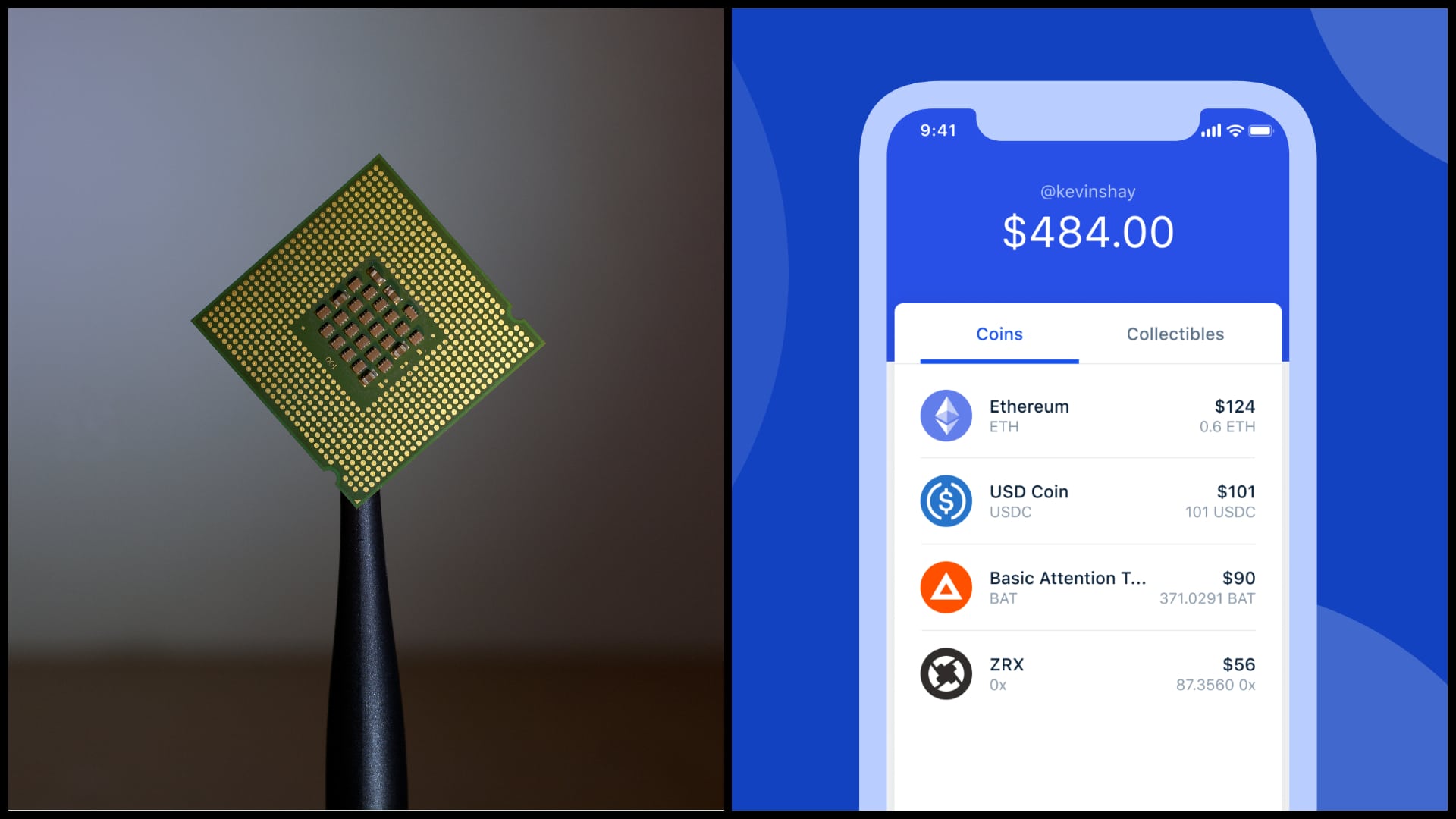

However, as the portal pointed out CoinDesk, enthusiasts of cryptocurrencies and the stock market itself are not the only ones holding Coinbase shares. According to a report brought by the website Barron’s, the largest chip maker Intel said on Friday that it owns a stake of 3,014 shares in Coinbas with a total value of about $ 800,000.

The California company reportedly had to buy the stock during the second quarter, which ended on June 26. However, Intel did not have to buy the shares publicly, because companies that go public are only required to report shares of at least 5%, which Intel does not have. However, the chip manufacturer must report share ownership in its results.

DON’T OVERLOOK

QUIZ: Do you believe 100%? Only a true enthusiast can handle these questions about cryptocurrencies

Coinbase in reporting quarterly results for the second quarter of 2021 on Tuesday showed that the potential in the stock market is really high. Revenue of $ 1.9 billion also surpassed analysts’ estimates, with the stock record up to 8.8 million users transacting each month and a total of up to 68 million users.

The stock exchange also announced that more than 9,000 financial institutions use it to create their own cryptomen products, while it also named SpaceX, Tesla and their boss Elon Musek as their partners.

However, Coinbase expects the number of active users and trading volume to be lower in the third quarter, also due to the cryptocurrency market and the “dry flight” we experienced until the positive trend that bitcoin has gained since the end of July.

Read also

Read also

INTERVIEW: The traditional system will collapse. This is the final product of cryptocurrencies, they will replace our finances

The company is the first large cryptomen exchange, whose shares are traded publicly on the American stock exchange. This means that they will probably soon be held by regular index funds, which will further connect the world of cryptocurrencies and ordinary investors.

However, the move has also been found by many critics, who point to the high risk of the company’s value, as it is too much tied to the prices of cryptocurrencies and the volume of transactions carried out on the platform, which will fall sharply if digital prices fall.