Best defi-tokens – DeFi (decentralized finance) is the area that attracts the most attention today. It includes a large number of services based on blockchain and smart contracts (automated executable agreements). Working with such projects does not require the participation of intermediaries – banks, government, lawyers.

DeFi tokens are digital assets belonging to such platforms. They usually perform some kind of functional role or several roles at once, act as a reward, and also represent promising trading tools. Defi tokens can be bought on many crypto exchanges, including Binance. On it, you can “ farm ” Bel and Wing tokens using the Binance Launchpool platform .

The editors of Bitcoinminershashrate.com have collected information about the currently demanded defi-tokens that have the greatest utility in their field.

The content of the article

Features and benefits of working with decentralized finance

Most of DeFi is built on the Ethereum blockchain network and is in the form of so-called dApps (decentralized applications). This is the next step in the evolution of financial technology. The first was made 11 years ago with the advent of Bitcoin.

The whole sphere can be conditionally divided into several areas:

- Decentralized exchanges . The most popular defi destination. Fully peer-to-peer platforms where users trade among themselves without intermediaries and censorship.

- Credit platforms . They allow you to take out a loan secured by cryptocurrency, or vice versa, lend your assets at interest.

- Synthetic assets . Creation and use of tokenized counterparts of fiat currencies, real goods, cryptocurrencies.

- Stablecoins . Development of crypto tokens, the value of which is always equal to the value of the associated fiat currency.

- Independent bets on the result of political, sports and other events.

- Win-win lotteries , where each participant after the drawing receives the invested funds back, and one lucky person wins the total interest that has accumulated in the common bank.

- Insurance and tokenized securities .

This is far from a definitive list. DeFi tools are sometimes compared to LEGO – you can assemble new interesting projects from their components to maximize profits or ensure the safety of financial assets. Many of the modern dApps are strictly niche, that is, relevant for one group of users / companies, but progress does not stand still and in the future applications can have a big impact on everyday life.

Why the demand for DeFi is growing

Defi tokens are actively spread mainly due to the lack of influence of regulators. For example, in classic lending, a legal requirement has been introduced for liquidity providers and borrowers to confirm their identity, namely, so that the lender can assess whether the borrower is capable of repaying the debt. There are no such requirements in decentralized finance, which ensures the safety of personal confidentiality.

There is another reason for the sharp surge in the popularity of DeFi tokens – this is the increased attention from large players, traditional financial institutions. For example, the Financial Times recently reported that 72 banks, including Santander and Société Générale, are joining the Interbank Information Network (IIN), which JPMorgan, ANZ and Royal Bank of Canada tried out last summer. The goal is to speed up transactions delayed by errors, checks or missing data using a single ledger of information.

Main directions of DeFi projects and examples of tokens

Consider the current DeFi platforms for 2020 and their tokens.

Landing page (loans and deposits)

DeFi token DFI.Money (YFII)

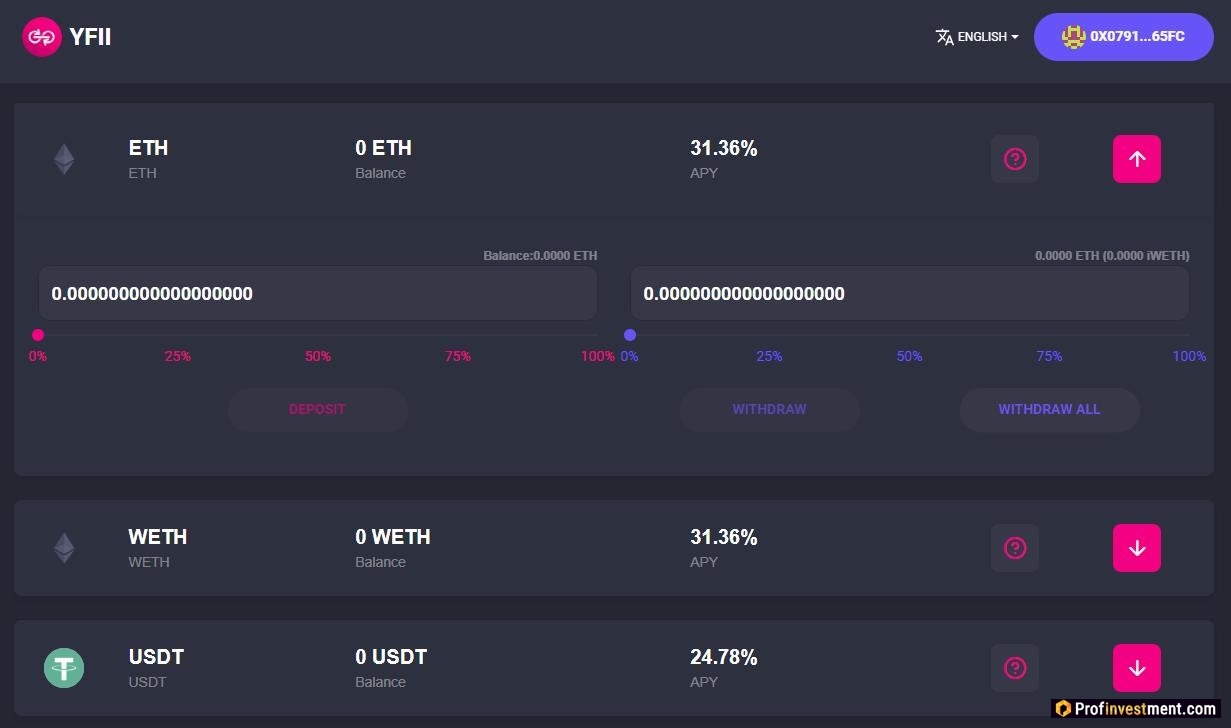

DFI.Money is an infrastructure where participants can receive profitability through aggregated liquidity and margin trading. The token of this YFII system is a fork of the YFI token and a service tool that pays rewards to liquidity providers and votes for changes to the protocol.

DFI.Money is an infrastructure where participants can receive profitability through aggregated liquidity and margin trading. The token of this YFII system is a fork of the YFI token and a service tool that pays rewards to liquidity providers and votes for changes to the protocol.

DeFi-токен Wing (WING)

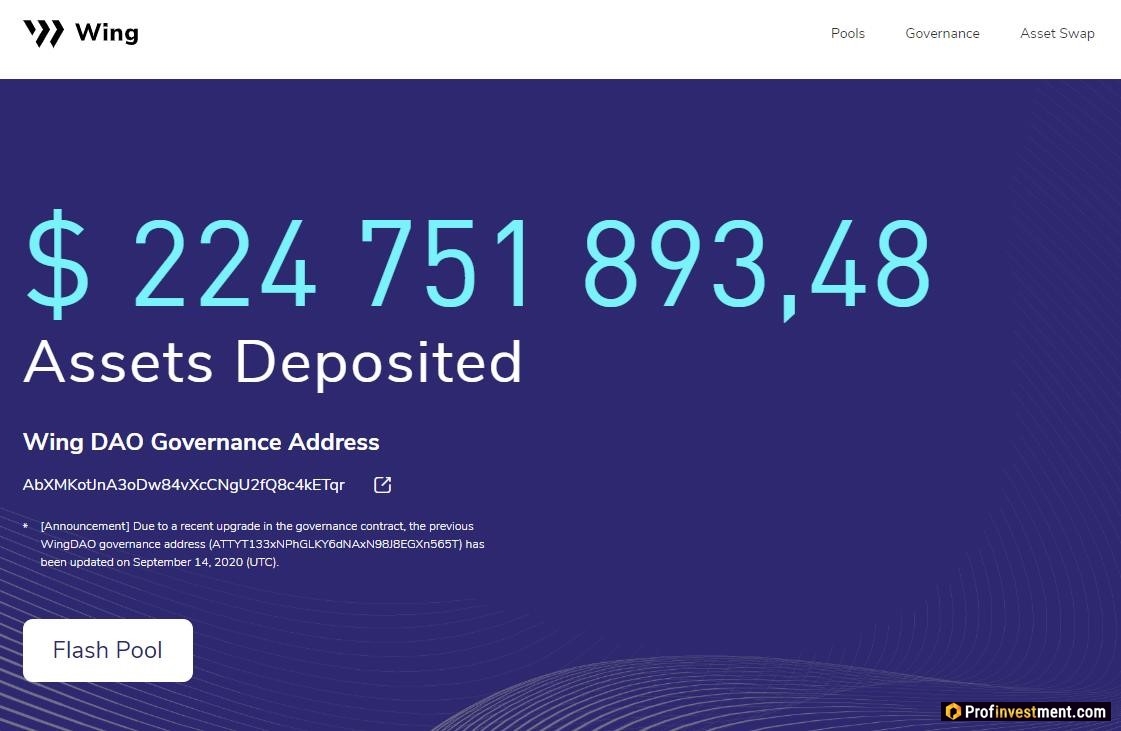

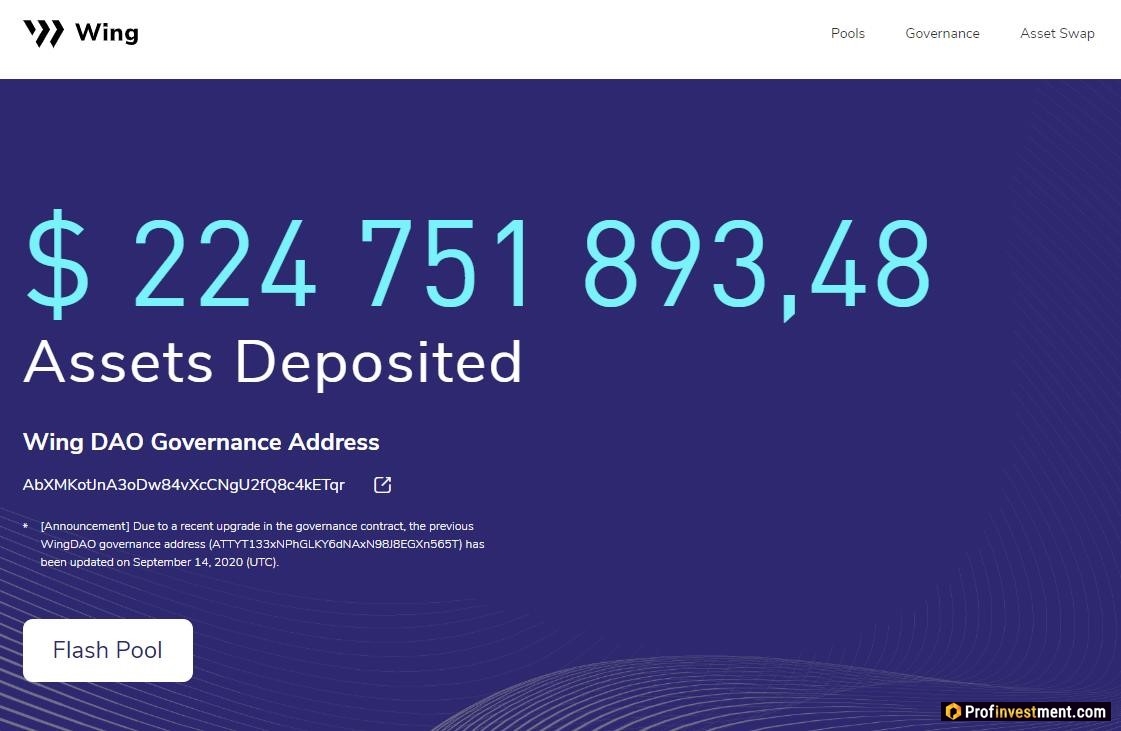

Wing is a digital asset lending marketplace that supports cross-chain interaction (transactions between different blockchains). Borrowers and lenders can build mutually beneficial collaboration through decentralized risk control and governance mechanisms.

The WING token is used to incentivize liquidity providers and depositors, and to administer the protocol through the community. WING is present on the Binance Launchpool platform.

DeFi-токен Aave (LEND)

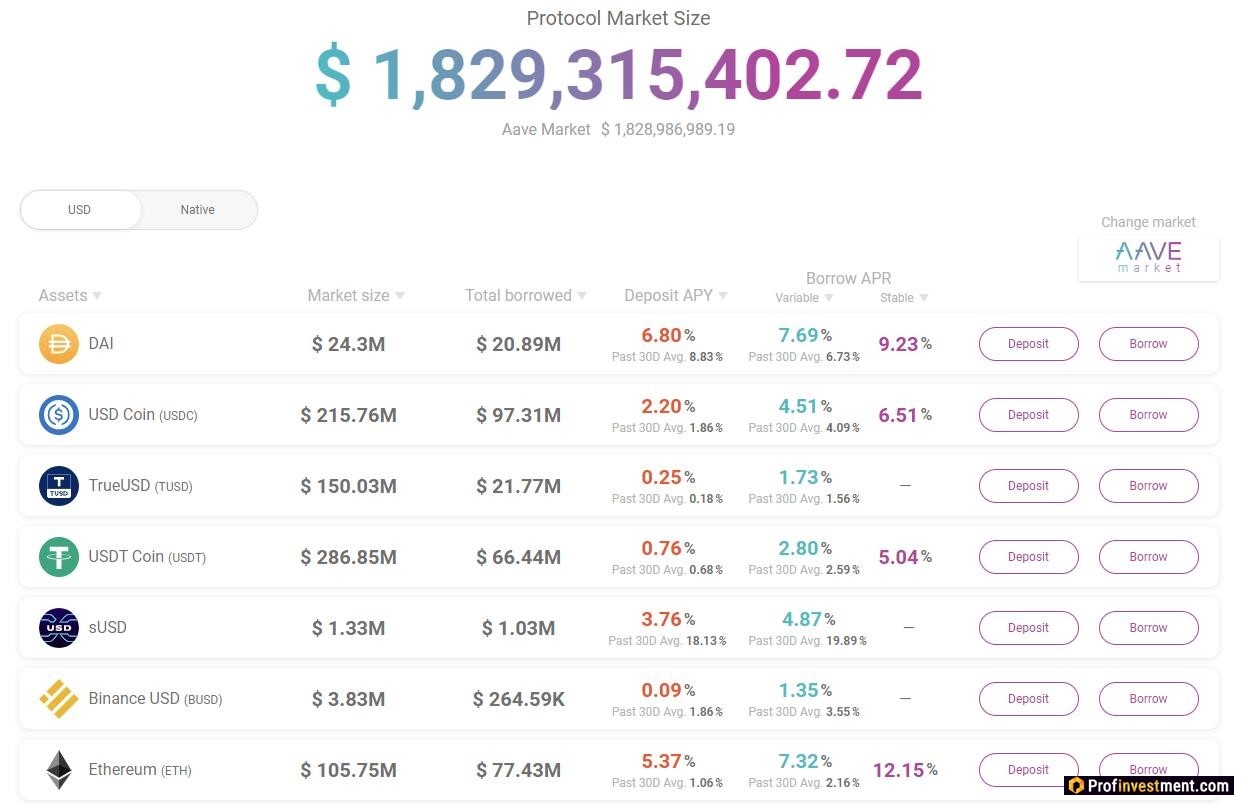

Aave is a lending and landing platform that does not require the user to provide personal information and does not store the keys to the wallet. It is open source, like almost all other defi projects. The work is based on a credit pool, which accumulates the funds of all users and assigns interest on loans and deposits algorithmically, based on the market situation. When used, the participant has the right to choose a variable or more stable interest rate.

The LEND token is used to perform control functions – with its help, users can vote for changes in the protocol, and the value of a participant’s vote is determined by the amount of his capital.

DeFi-токен Compound (COMP)

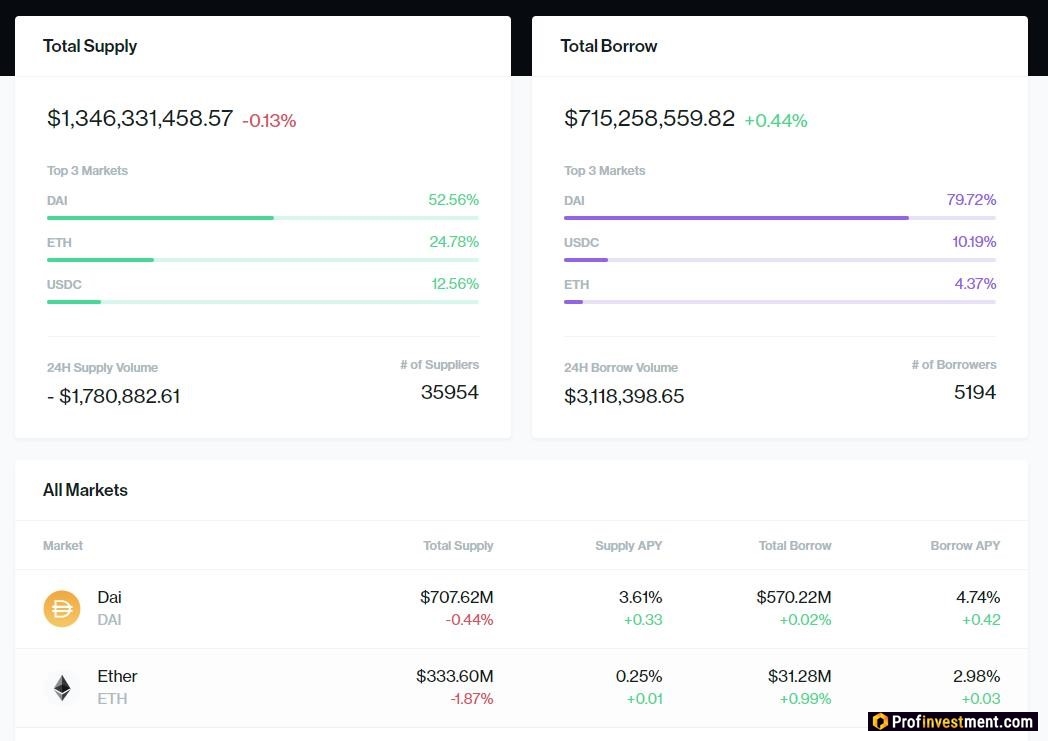

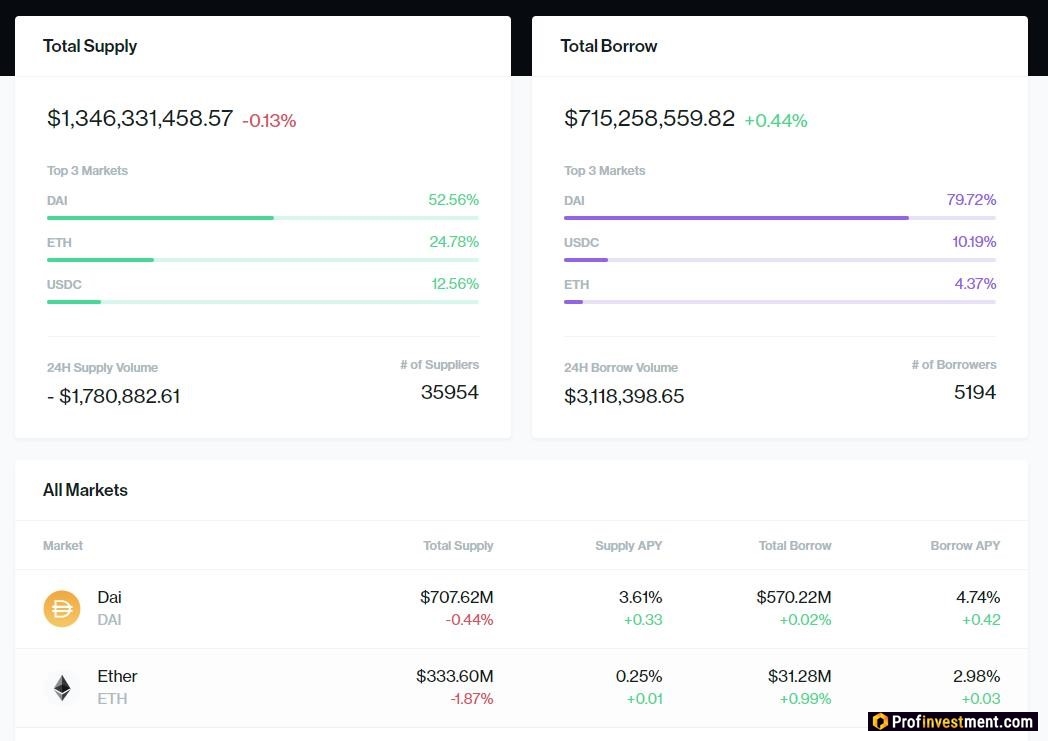

Compound работает фактически по тому же принципу, что и Aave. Это кредитный протокол, основанный на пуле ликвидности, где процентные ставки меняются каждые 15 секунд (после каждого нового блока в блокчейне Ethereum). Протокол отличается высоким LTV – 100%, то есть доступно соотношение между кредитом и залогом 1:1.

COMP – токен DeFi платформы Compound, предоставляющий возможность участия в управлении протоколом. Изменения могут касаться таких моментом, как листинг или делистинг валют, особенности управления системой, методы расчета процентной ставки.

Трейдинг, обмен активами

DeFi-токен Uniswap (UNI)

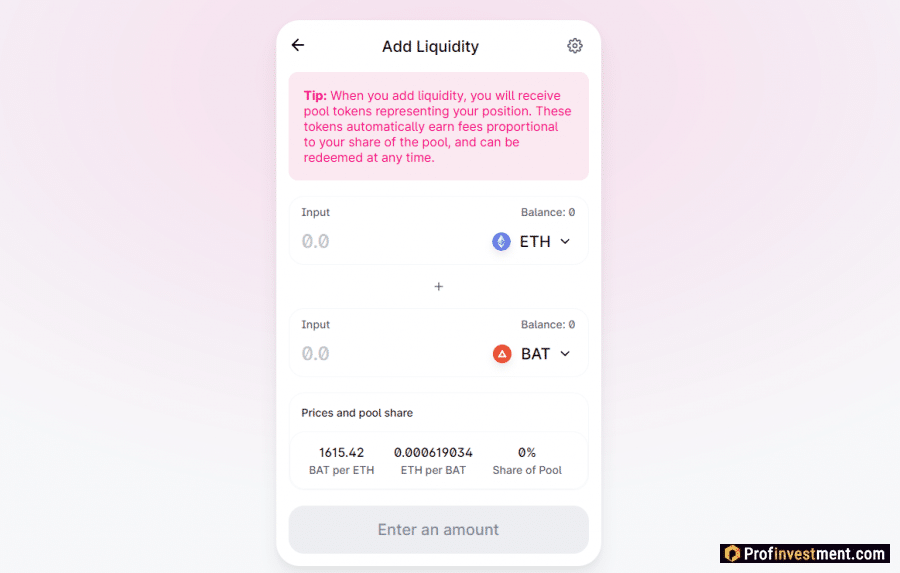

The Uniswap decentralized exchange is the most requested DeFi app to date. Allows you to exchange Ethereum and ERC-20 tokens with minimal costs; the exchange is based on the use of liquidity pools. At the same time, those who contribute liquidity to the protocol are rewarded.

The new UNI token opens up a lot of opportunities for holders to manage, vote for changes in the project. Its main goal is to make the platform completely autonomous and self-sufficient. The token was added to a number of major exchanges right after the release, including Binance.

DeFi-token SushiSwap (SUSHI)

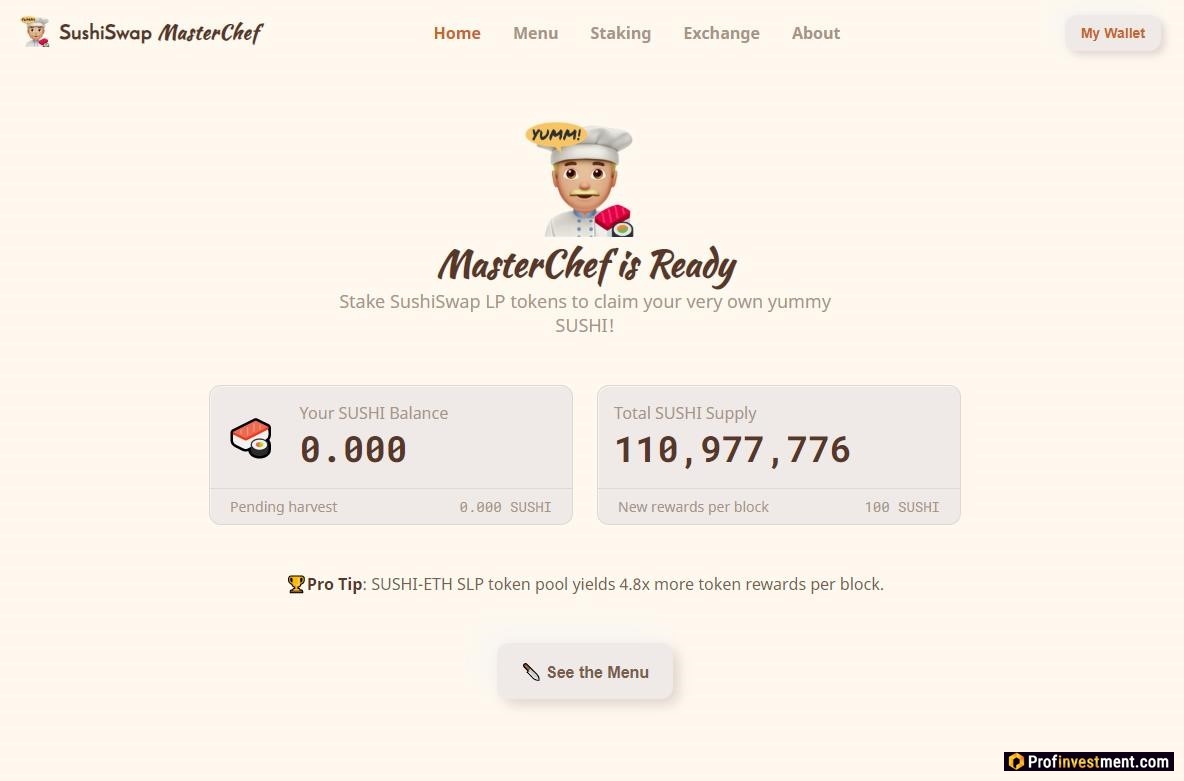

SushiSwap is a decentralized marketplace based on a pool of liquidity. Users who add liquidity to the pool receive a reward in SUSHI tokens, and in addition, they continue to receive it even when they have already withdrawn funds. This is a kind of bonus for those who supported the platform at the initial stages of development. Initially, liquidity will be carried over from Uniswap (a previous project by the same developers).

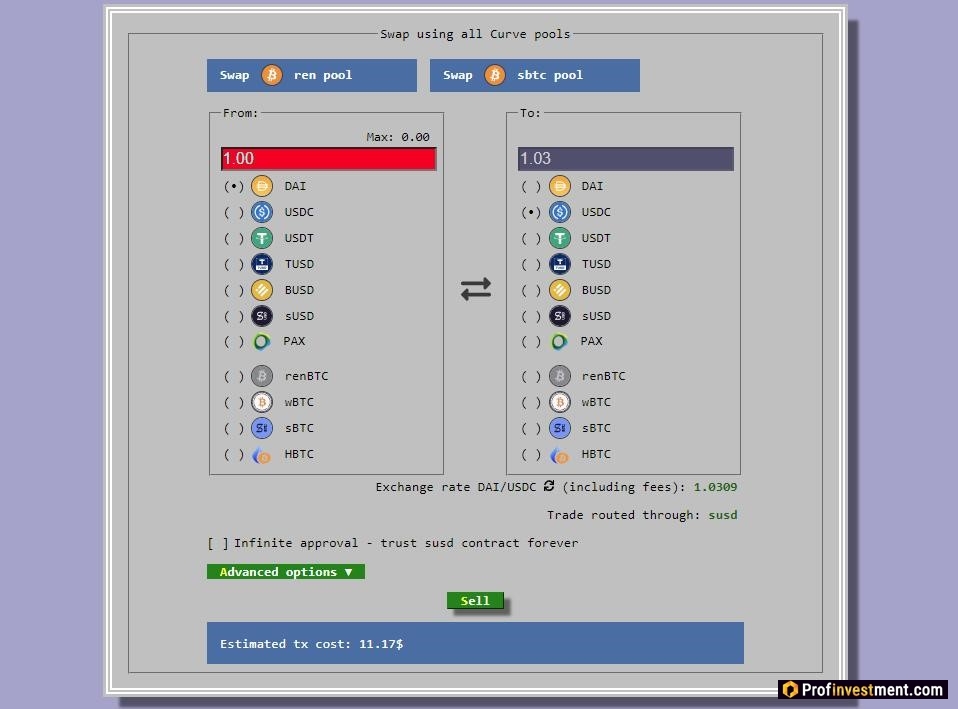

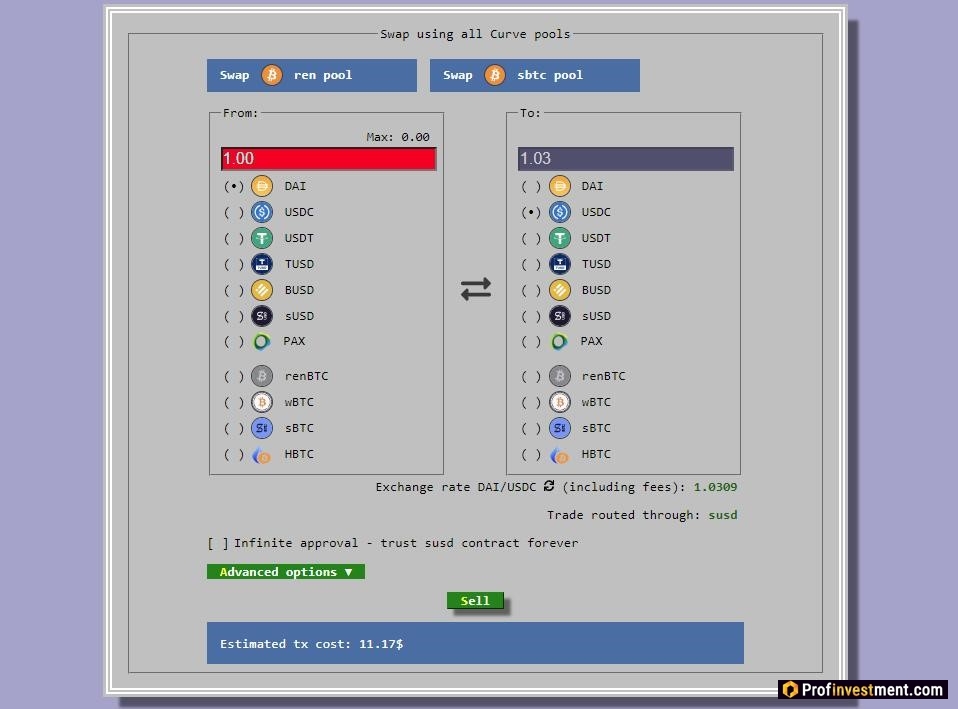

DeFi token Curve DAO (CRV)

Curve is a DeFi trading platform that, instead of connecting two specific users for exchange, creates a common pool with automated trading using special algorithms. The work uses a connection to other external protocols such as Compound. The CRV token is used for voting management and also performs a number of technical functions such as burning commissions.

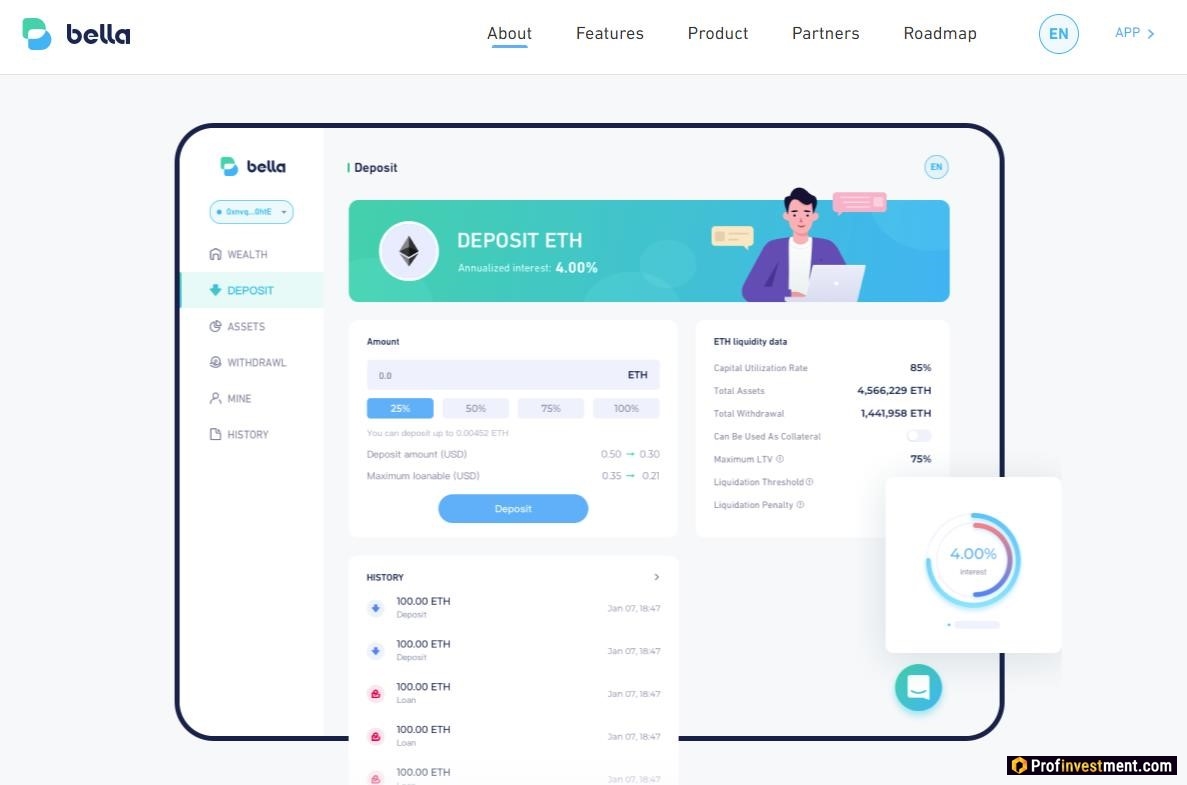

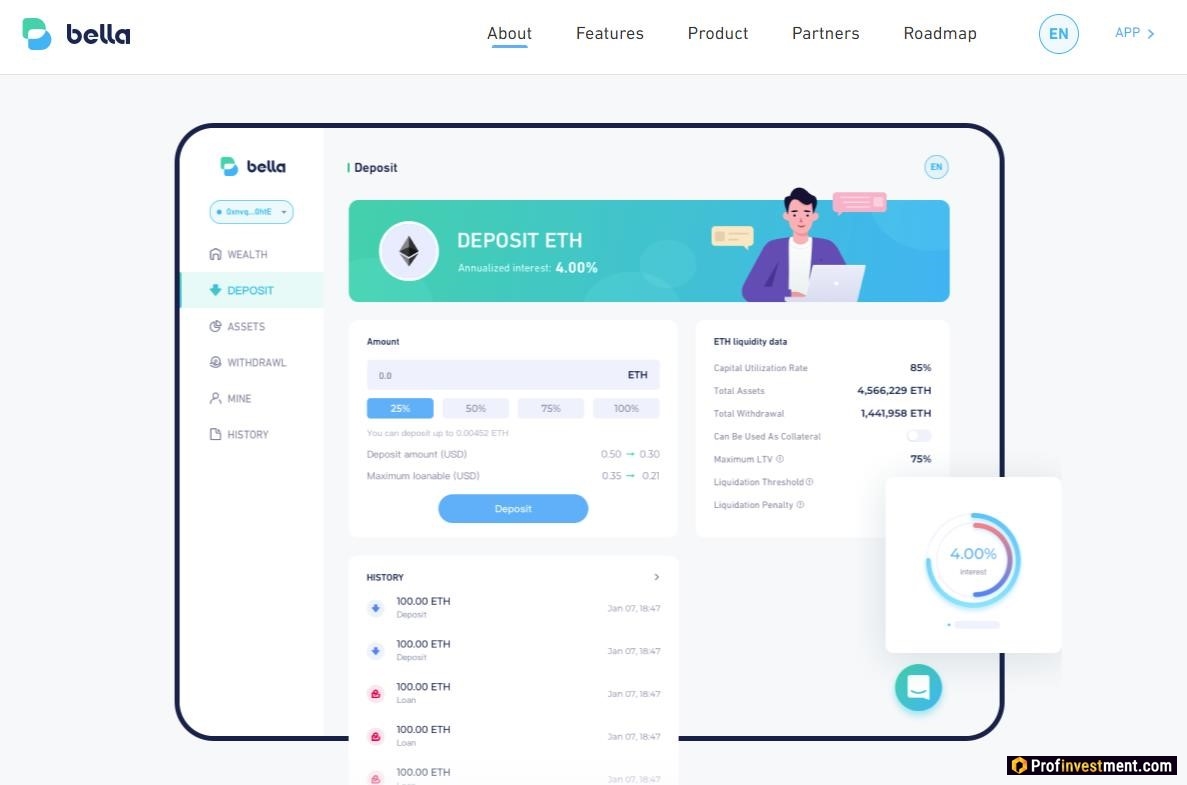

DeFi token Bella Protocol (BEL)

The Bella Protocol will launch in the coming months, but the BEL token is already available for trading on select exchanges (and is also the first project launched under the Binance Launchpool).

The essence of the project is to make the interaction of users with the DeFi infrastructure as easy as possible. The “1-Click” system allows you to effectively distribute investments according to different credit protocols in order to get the highest possible income. There is a robotic advisor. Initially, there will be zero commission fees.

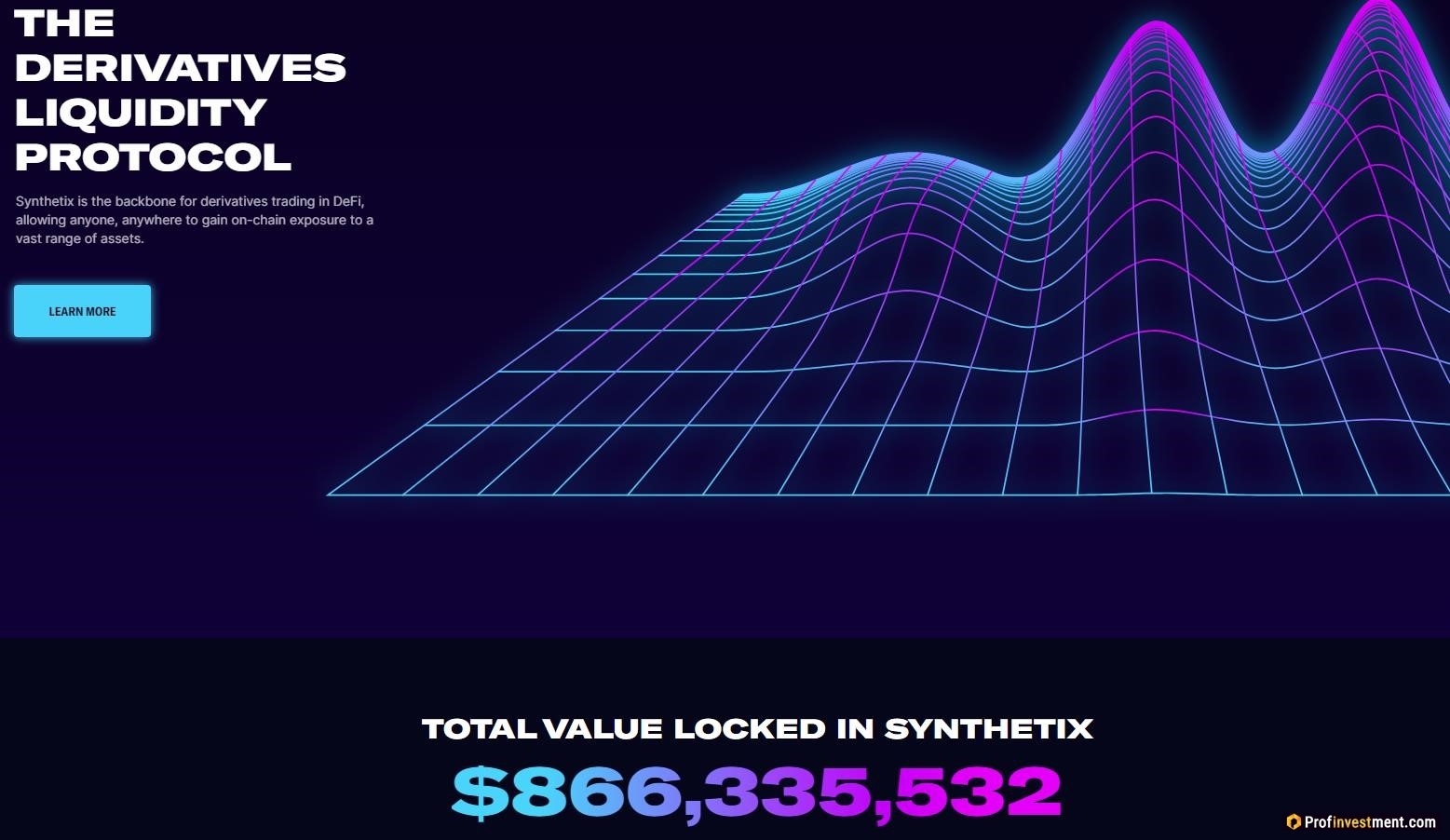

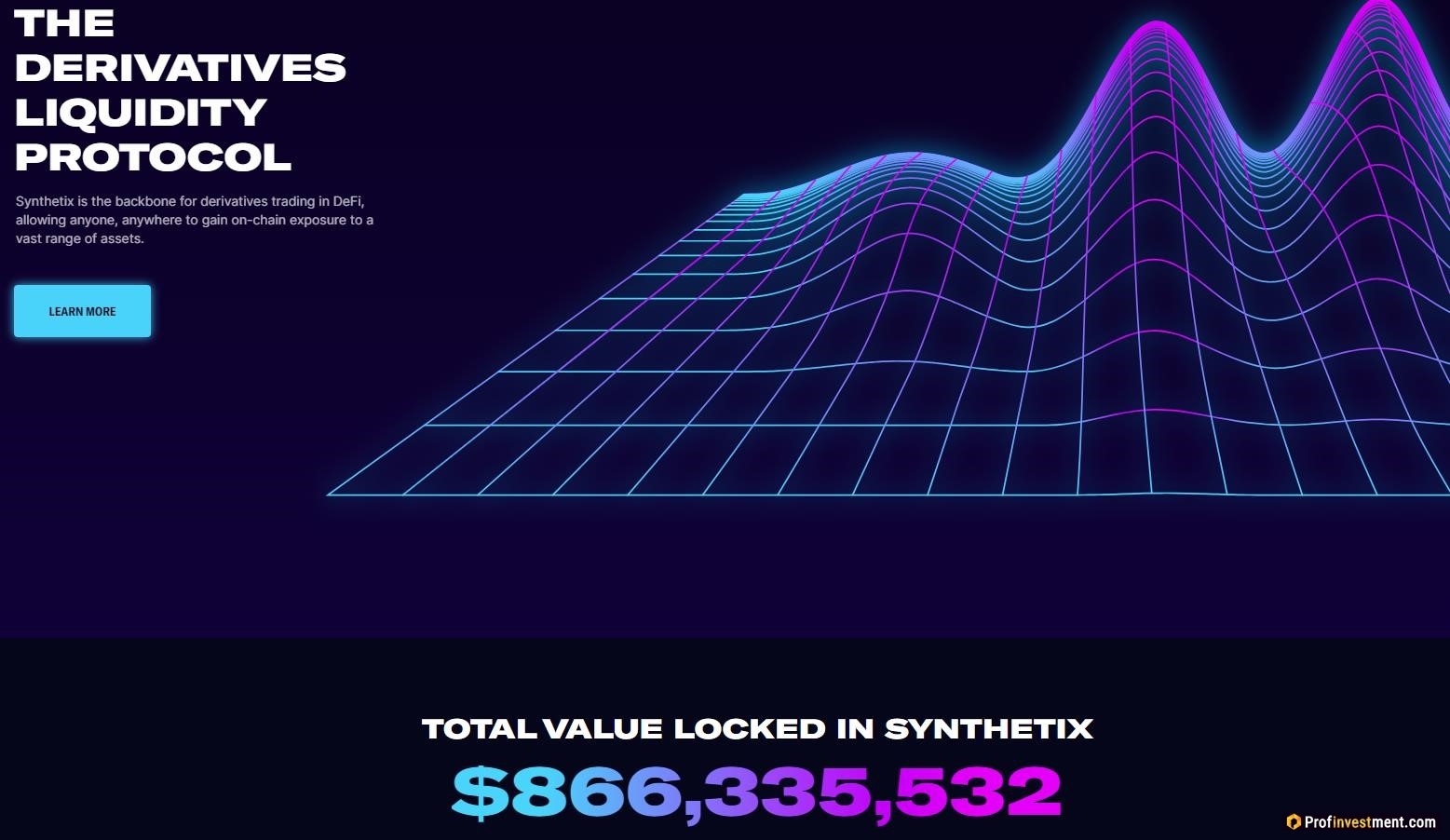

Deity Token Synthetix (SNX)

Synthetix is an Ethereum platform for creating synths – synthetic assets, the value of which is based on the value of real world assets or other cryptocurrencies. The unified provisioning model helps participants to perform exchanges between synths directly using a smart contract, avoiding the need to find a counterparty. The mechanism solves the liquidity and slippage problems often faced by decentralized exchanges.

Synthetic assets are backed by the Synthetix Network Token (SNX). SNX holders are incentivized to keep their tokens locked as they are paid a prorated portion of the trading fees generated by users’ transactions on Synthetix. The operations themselves do not require SNX.

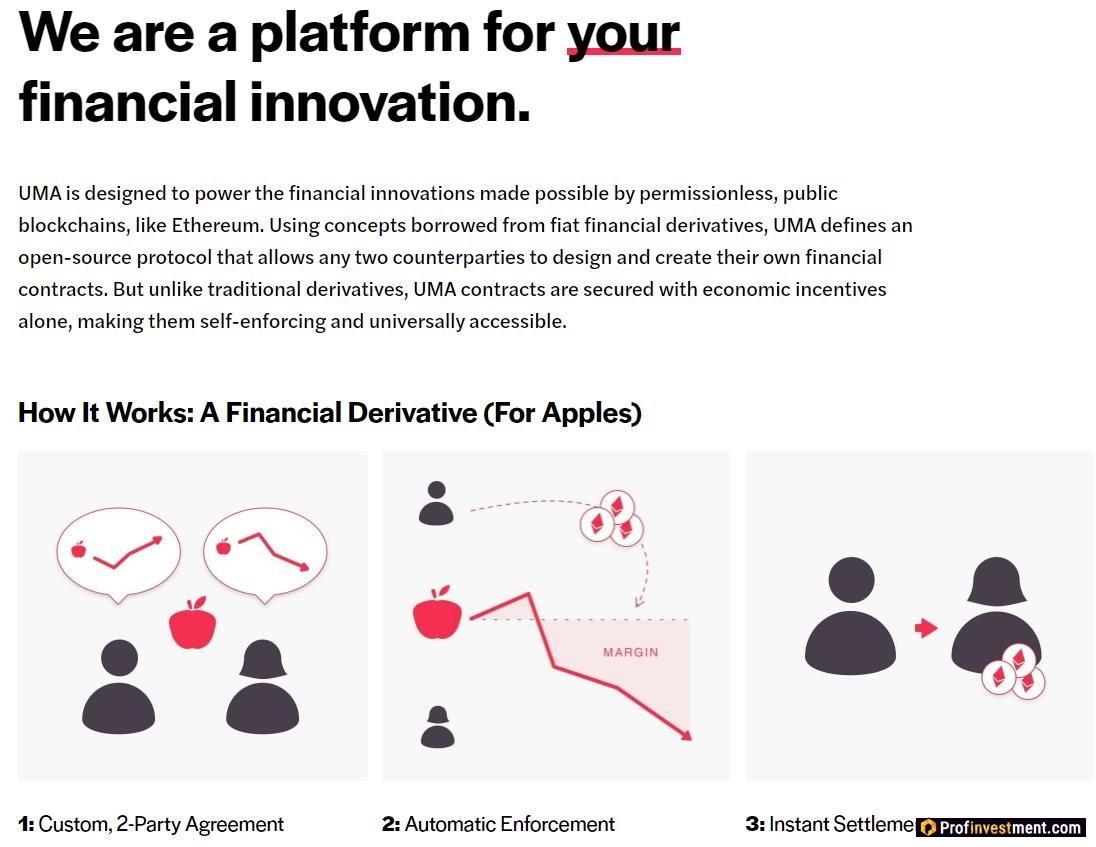

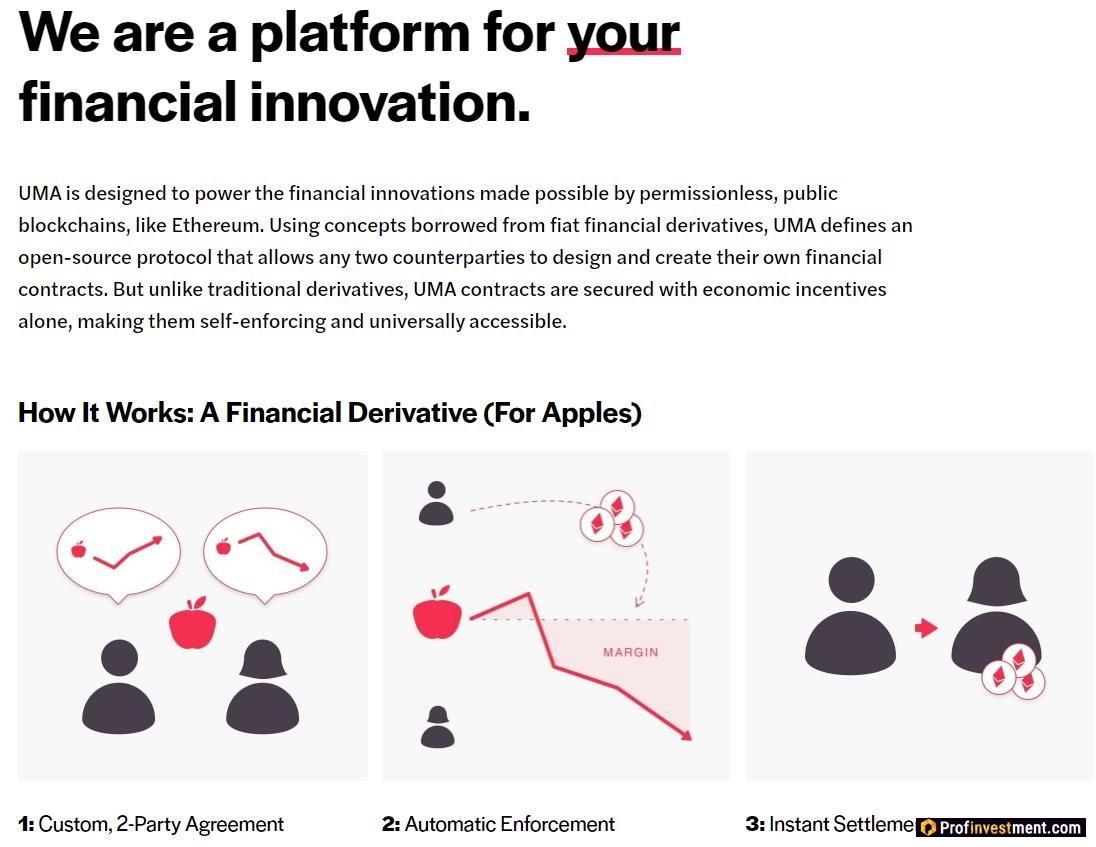

DeFi token UMA

UMA – DeFi protocol for creating and managing financial contracts and assets. Provides the ability for any two counterparties to interact using independently created tools, while maintaining the public availability and independence of contracts.

The UMA token belongs to the category of managers, that is, it gives the holders the right to influence protocol adjustments.

DeFi token yearn.finance (YFII)

yearn.finance is a multifunctional platform that allows you to decentralized exchange of tokens, earn interest income, borrow funds, insure assets, etc. The protocol is now under active development and adding new functions, and its YFI token, as well as the YFII fork, feel confident On the market. The ecosystem works in conjunction with several popular lending protocols.

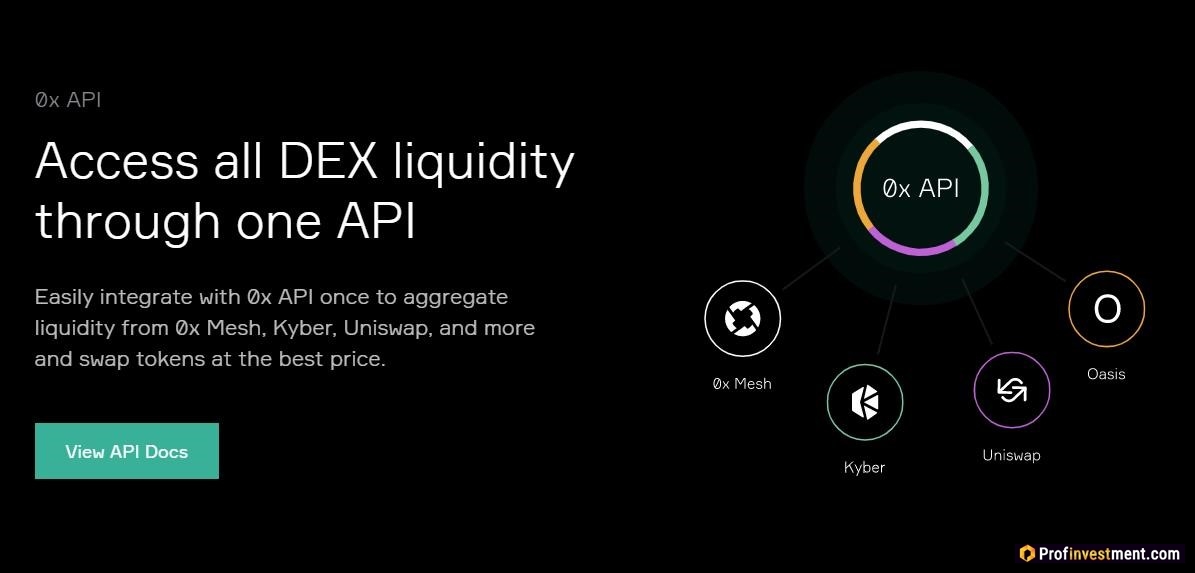

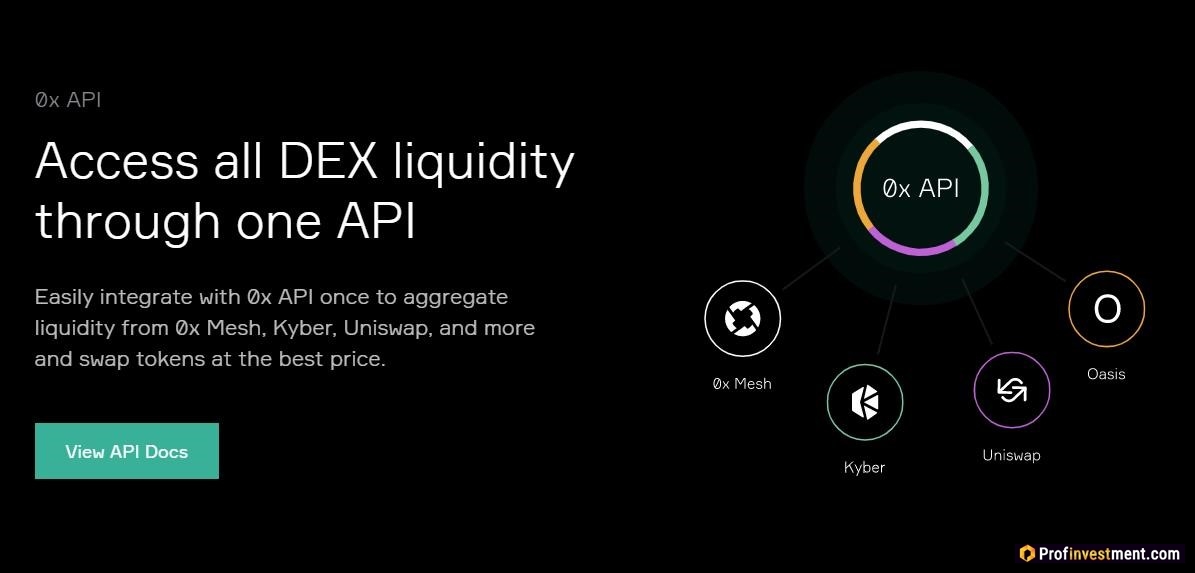

DeFi token 0x (ZRX)

The 0x protocol is an open source infrastructure used by developers and companies to create products that facilitate crypto token trading. Facilitates the decentralized exchange of any Ethereum-based tokens, including the ERC-20 and ERC-721 standards. The modular system makes it easy to add trading functionality to any product.

The tokens of this defi project are called ZRX and can be used to earn money by staking.

Oracles

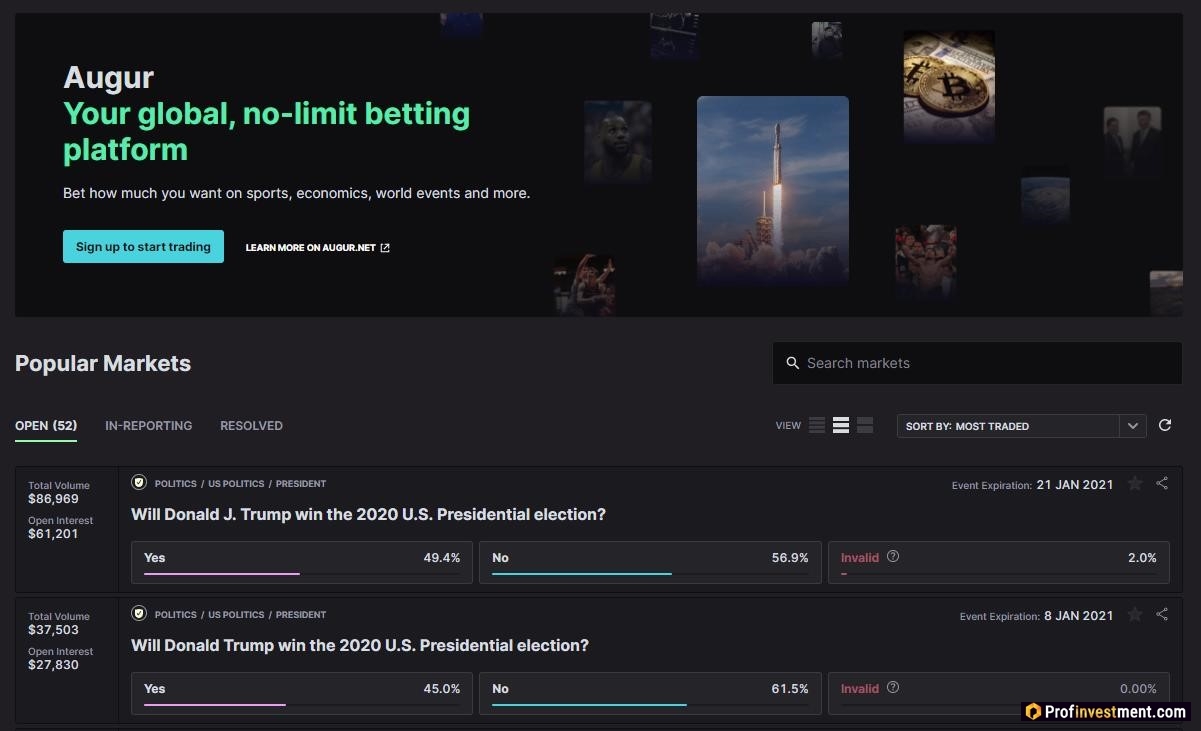

DeFi token Augur (REP)

Augur is a decentralized oracle and peer-to-peer platform that is an Ethereum-based prediction market. Allows anyone to create markets for a variety of real-world events. In other words, it is a free open source betting exchange protocol that is user-driven on a peer-to-peer basis; at the same time, Ethereum smart contracts are used, which regulate the rules of interaction.

REP is the native De-Fi token of the Augur application. It is used during the creation of markets, as well as for reporting and resolving disputes. The user can place a REP to earn reporting fees or dispute the outcome of a conflict.

DeFi-токен Chainlink (LINK)

Chainlink is one of the first decentralized oracles. Provides communication with external events (payments, data) using complex smart contracts. The contract can connect to the API and receive information in real time outside of its own blockchain.

DeFi token LINK is an ERC677 token, the functionality of which is inherited from the ERC20 standard and enhanced by the ability to transfer assets containing payload in the form of data. Used to reward node operators for pulling data for smart contracts and for other purposes.

Stablecoins

Defi Token Maker (MKR)

Maker is a decentralized Ethereum platform that supports the DAI stablecoin pegged to the USD value. The native Oasis app allows you to use this token for trading, loans or deposits. Other supported coins and tokens are ETH, USDC, BAT, USDT, COMP and others, for a total of 13. The MakerDAO ecosystem is at the heart of 400+ decentralized projects and services.

DeFi-токен Wrapped Bitcoin (WBTC)

Wrapped Bitcoin (WBTC) – according to the developers, a combination of the power of Bitcoin and the flexibility of ERC-20 tokens. Tokenized Bitcoin. In fact, a stablecoin equated to the BTC rate is completely transparent and verifiable.

WBTC brings additional liquidity to the Ethereum ecosystem, in particular when trading on decentralized exchanges or performing transactions in various dApps. This helps to transfer bitcoin liquidity into a defi environment, pulling it away from centralized platforms. Also, using this tool, it is convenient to create smart contracts that include BTC transfers.

How to make money on decentralized assets

The most popular and reliable way to earn money on DeFi tokens today is considered to be the deposit of funds at interest in credit pools. This is convenient because, unlike banks or centralized lending platforms:

- The entry threshold is minimal. You can earn from any amount.

- No deposit freeze. It is allowed to withdraw your funds and interest at any time without any penalties.

- Convenience. No identity checks, just connect to the pool with a decentralized wallet and manage your finances.

The profitability in credit pools is not fixed, but depends on the supply and demand for specific tokens within the pool. Sometimes the percentages can be minimal, sometimes very good.

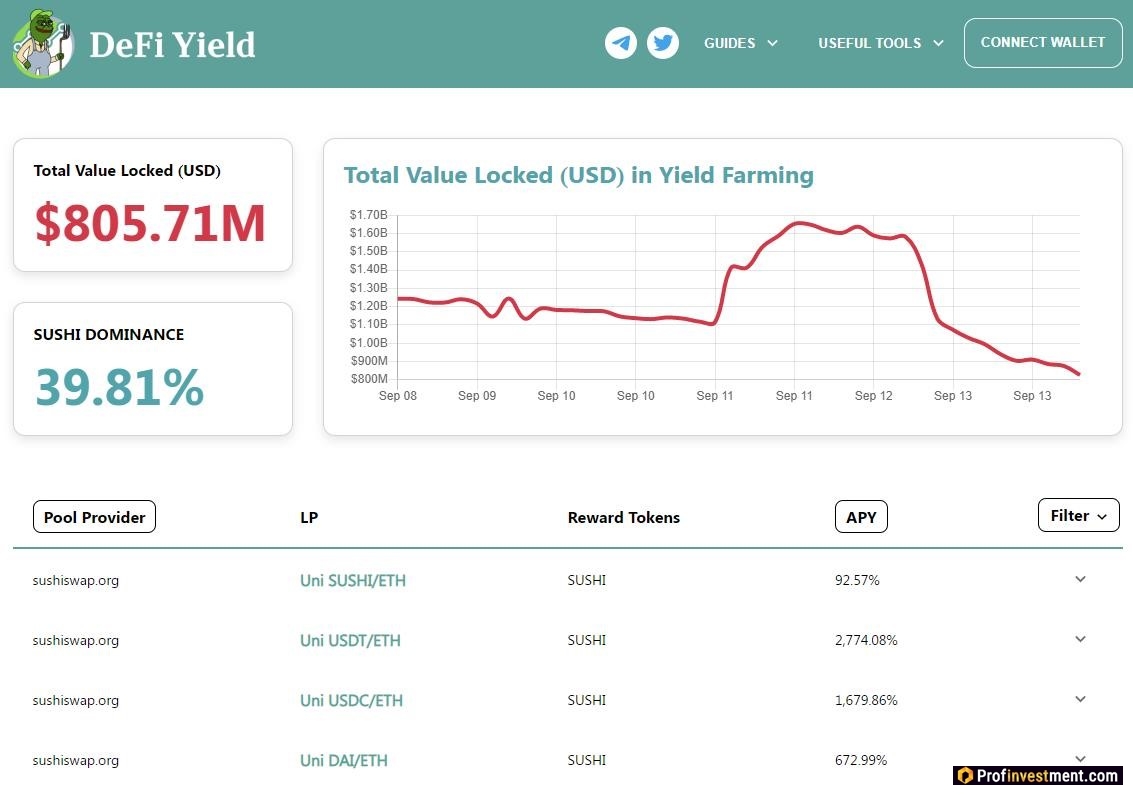

There are aggregators of the profitability of DeFi pools that will help assess the situation and understand where it is most profitable now. Examples of such aggregators:

- https://defiyield.info/

- https://yieldfarmingtools.com/pools

- https://www.coingecko.com/ru/defi

Conclusion

Conclusion

Many of the tokens described have already been added to major crypto exchanges, including Binance, which in general is actively promoting the development of the DeFi sphere. All tokens play an important role in their ecosystems, are their support and driving force. Certain assets are also suitable for market speculation due to extremely high volatility. In the article, we have listed the def tokens that have a high capitalization, which means they are the most promising at the current time.