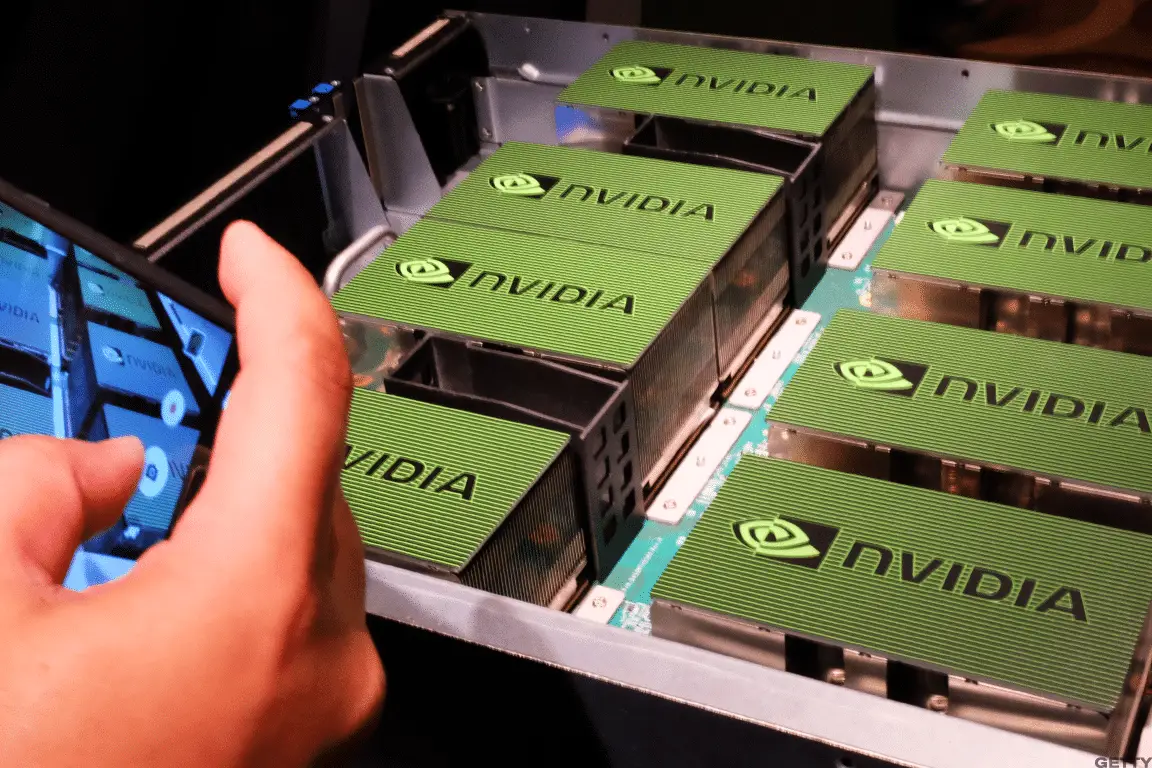

Nvidia, the multinational chip manufacturing giant, was sued again by some investors who accuse him of not reporting $ 1.1 billion in sales related to the cryptocurrency mining business between May 2017 and July 2018.

Nvidia's management has knowingly deceived the market and investors

According to The Register, the computing giant was accused by a group of shareholders for disguising more than $ 1 billion in sales revenue from the graphics processing units (GPUs) used for cryptocurrency mining, presenting them as sales earnings of gaming hardware.

The share class lawsuit accuses CEO Jensen Huang, CFO Collette Kress and Jeff Fisher, senior vice president and head of games, claiming that they were fully aware of the size of mining-related sales compared to gaming and would therefore have deceived the market. .

The company has already faced similar cases in the past, but the latter complaint (obtained by modifying the text of a previous one) filed in a federal court in California in recent days could have unpleasant implications.

The cause dates back to the heyday of the crypto sector in 2017. The plaintiffs argue that "the defendants opted for a strategy that would capitalize on the miners' huge demand for GeForce GPUs, lying investors that the peak in GeForce sales it came from the players, not the miners. "

In this way, they argue that the company wanted to make it appear that its revenue was sheltered from the ups and downs of the cryptocurrency markets. "Defenders refused to publicly acknowledge that NVIDIA's growing sales were the result of purchases by unstable cryptocurrency miners, fearing investors would reduce the value of the Company's shares to reflect the volatility of cryptocurrency demand. ”, States the document.

In other words, Nvidia's conduct would have led investors to buy shares based on inaccurate information.

Unexpected losses of 20% for investors

In 2018, Nvidia's share price plummeted 20% after demand declined due to the decline in the mining race that occurred the previous year. As cryptocurrency prices have fallen significantly, profits have also been hit, forcing the company to close many deals.

Through a jury trial, shareholders now claim damages to the company and its executives for what they claim is a violation of the United States trade law for misrepresenting the origin of Nvidia's revenue in a limited period of time.

It therefore seems hard times for Nvidia actions. That's why we recommend trading cryptocurrencies with automatic trading platforms like Bitcoin Pro. Have you ever traded in crypto currencies? This may be the best time.