Venus overview of the token and the decentralized financial protocol, features, prospects. Venus – a decentralized marketplace with landing and lending capabilities. It is an algorithmic DeFi system running on the Binance Smart Chain architecture. It allows users to borrow cryptocurrencies with the condition of excess collateral, as well as receive additional income by giving their cryptocurrency into circulation at interest.

Interest rates are set by the protocol automatically based on supply and demand for a specific currency. Venus differs from many other DeFi protocols in that collateral can be used not only to borrow other coins, but also to issue synthetic stablecoins, backed not by fiat, but by crypto.

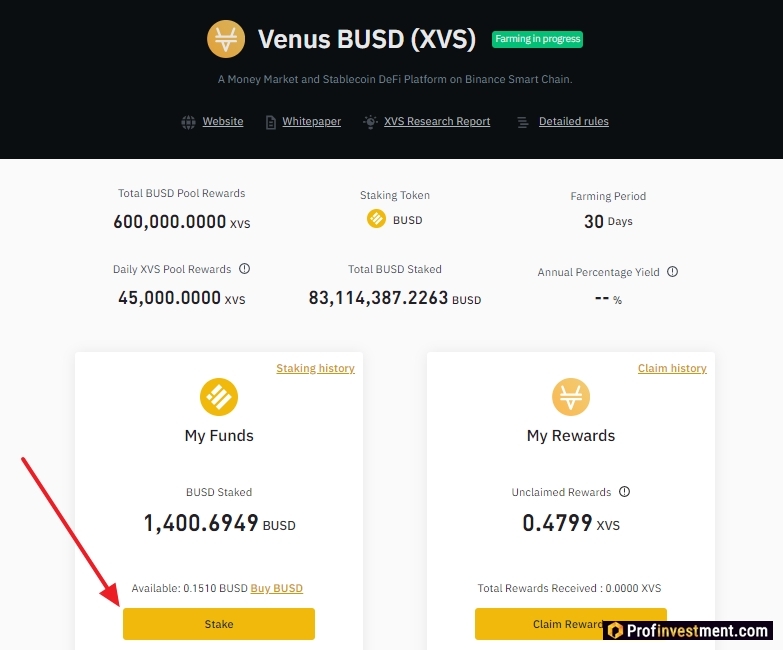

XVS is a native token of the BEP-20 standard. Serves for platform management (voting for various solutions aimed at improving the product). From 29.09.2020 the token is available for farming on Binance Launchpool for stakers of assets such as BNB, BUSD and SXP.

On October 6, 2020, the coin will be listed on the Binance exchange and trading in the pairs XVS / BTC, XVS / BNB, XVS / BUSD and XVS / USDT will be opened. In the meantime, the Bitcoinminershashrate.com editors will talk about the value of the Venus platform and its functional token.

New #Binance Launchpool project: $ XVS.@VenusProtocol is building a #DeFi money market platform on #BinanceSmartChain to enable digital asset lending & generation of synthetic stablecoins.

Learn more with the #XVS research report ⬇️https://t.co/X4ipyrxuFs

– Binance (@binance) September 28, 2020

The content of the article

Specification information

| Name | Venus |

|---|---|

| Ticker | XVS |

| Token type | BEP-20 |

| Blockchain | Binance Smart Chain |

| Total emission | 30 000 000 XVS |

| Official site | https://venus.io/ |

| Whitepaper | https://venus.io/Whitepaper.pdf |

| Blog | https://medium.com/VenusProtocol |

| Open source | https://github.com/SwipeWallet/Venus-Protocol |

| https://twitter.com/VenusProtocol |

Features of the Venus platform

Key characteristics of the Venus marketplace and functionality for creating synthetic stablecoins:

- The ability to quickly borrow cryptocurrencies and stablecoins without checking credit history and solvency. Carried out on the Binance Smart Chain.

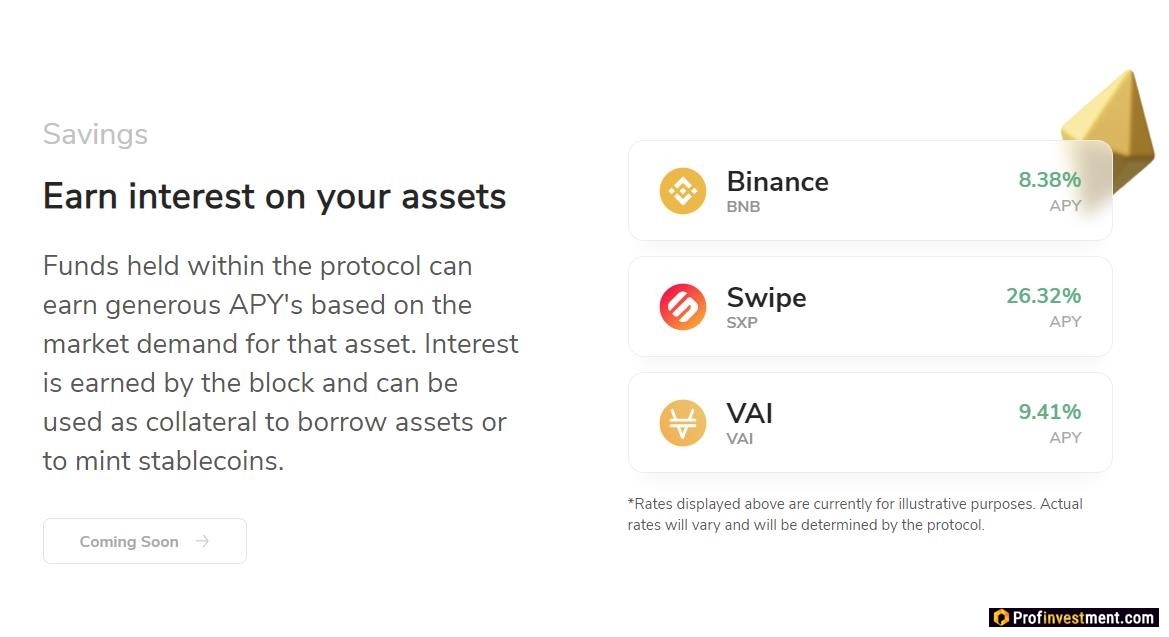

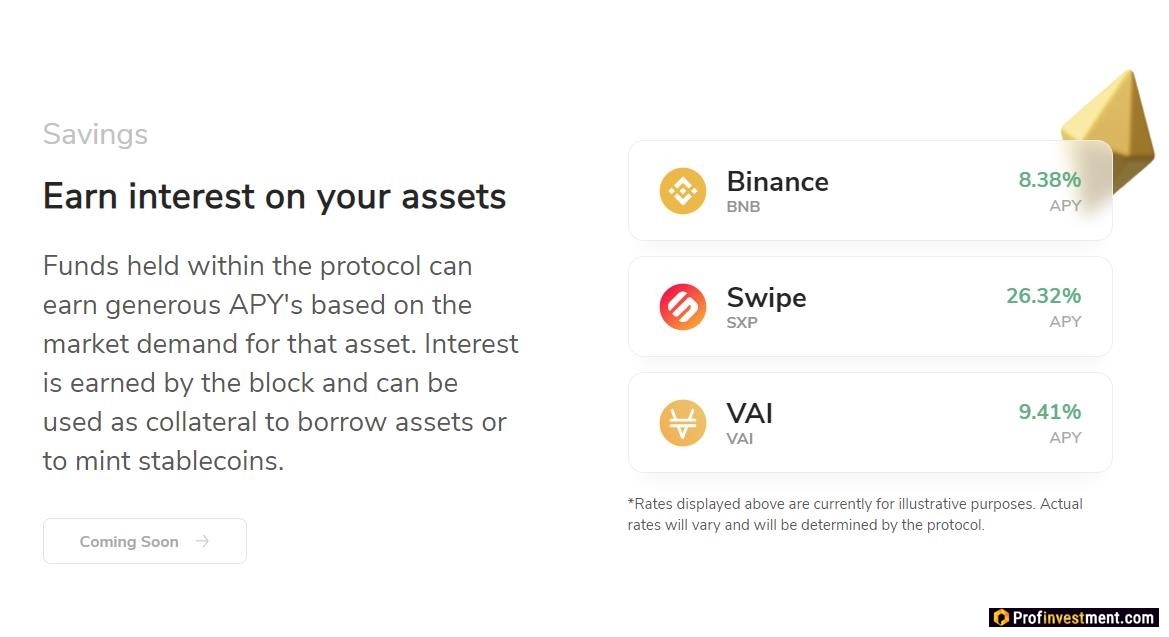

- Providing interest-bearing cryptocurrencies and stablecoins to earn a variable interest rate and ensure the liquidity of the protocol.

- Minting stablecoins based on collateral with the ability to use them through the Swipe platform.

- Fair distribution of tokens among the community.

Venus Landing

Users of the Venus protocol can deposit various supported cryptocurrencies or other digital assets into the system and earn an interest rate that changes periodically based on market analysis. All user assets are combined into a single smart contract. The user can withdraw his liquidity at any time if the protocol balance is positive.

Users who supply their cryptocurrency to the protocol receive a vToken, for example, for BTC – vBTC, which allows them to be used to hedge risks or move to wallets that support work with the Binance blockchain.

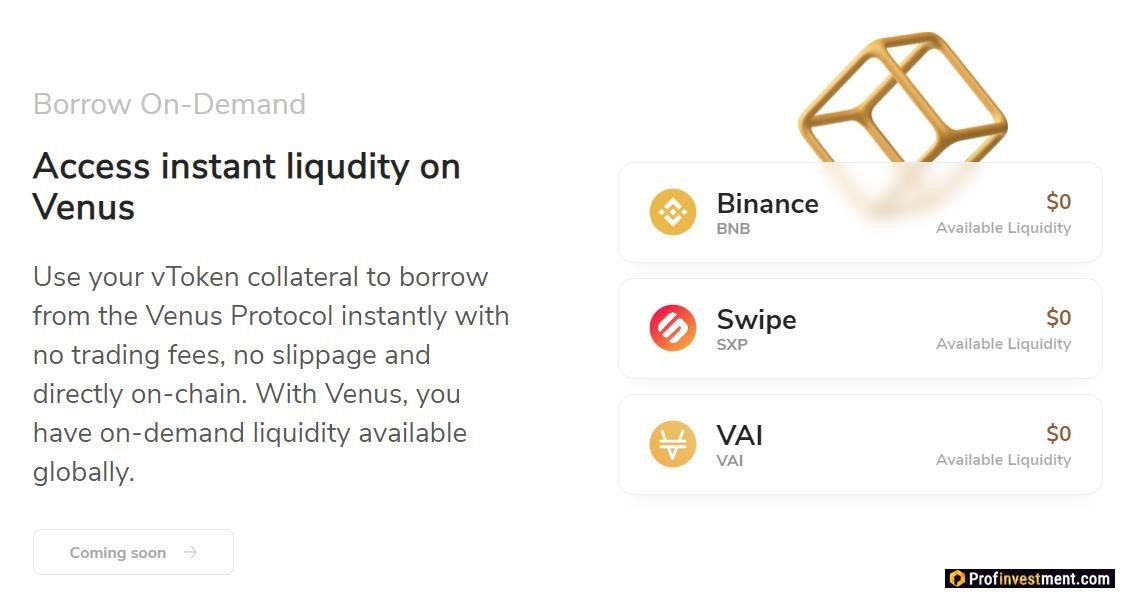

Venus Credits

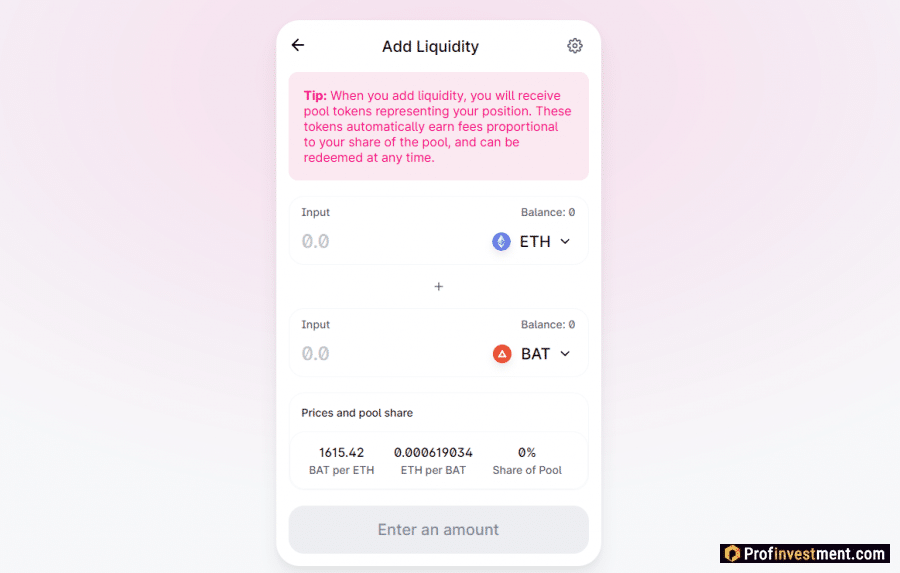

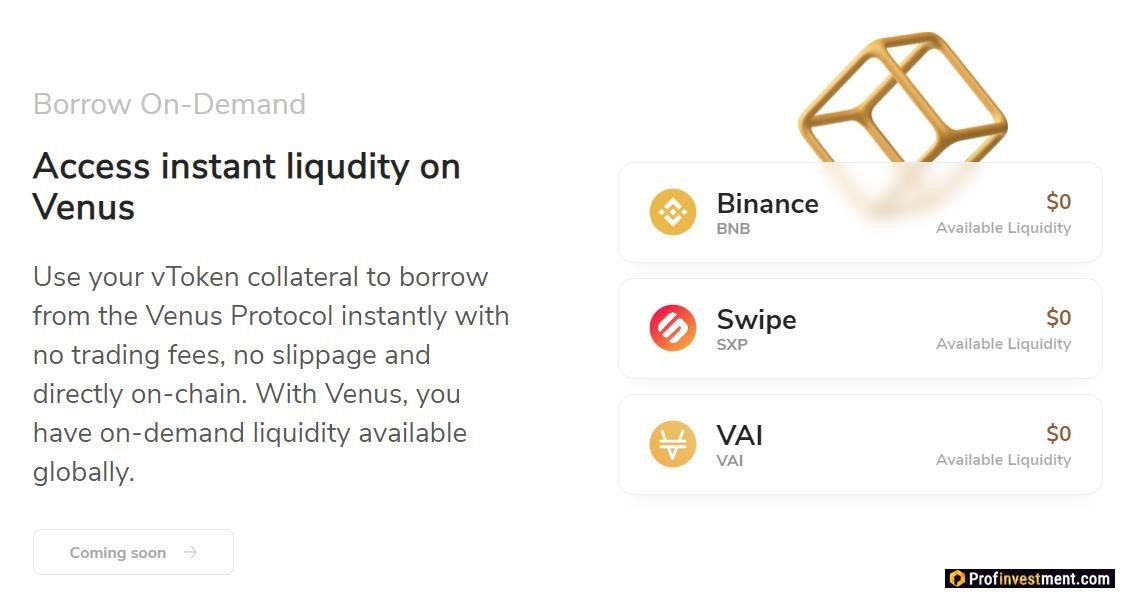

Users wishing to borrow any of the supported cryptocurrencies, stablecoins, or digital assets on Venus need to have collateral entered into the protocol. LTV – usually ranges from 40 to 75%, that is, coins are available at the rate of 40-75% of the value of the collateral. The exact figure depends on the chosen currency. The coefficients are determined by the protocol and can be adjusted later in the process of decentralized management.

Once the assets are provided, the participant can take out a loan based on the collateral ratio of the asset. If during the use of the loan the collateral value falls below 75% (this is the same level for all, regardless of the asset), the liquidation process may be triggered.

The user does not have obligations for monthly payments, the main thing is that the collateral ratio is always maintained at the required level. When it falls, you can either pay off part of the loan or add collateral.

Venus Synthetic Stablecoins

The Venus protocol generates VAI, a synthetic stablecoin pegged to the value of the US dollar. For this, vTokens are used from the total pledge entered into the protocol. Users can borrow up to 50% of the remaining collateral value provided by their vTokens in order to minting VAI.

In the future, VAI will become the main stablecoin of Venus, it will be used in the protocol, but interest rates will not be determined algorithmically, but by the company’s management.

Xокен XVS на Binance LaunchPool

The XVS token is a native token of the Venus protocol that will be fairly distributed among the community. There are only two ways to get tokens – within the Binance LaunchPool project and further by providing liquidity to the protocol (profitable farming).

#Binance Launchpool has a ~400% Yield Boost for $XVS on the first week of farming up until listing!

Details: https://t.co/8T26VM9fD8

– Venus (@VenusProtocol) September 29, 2020

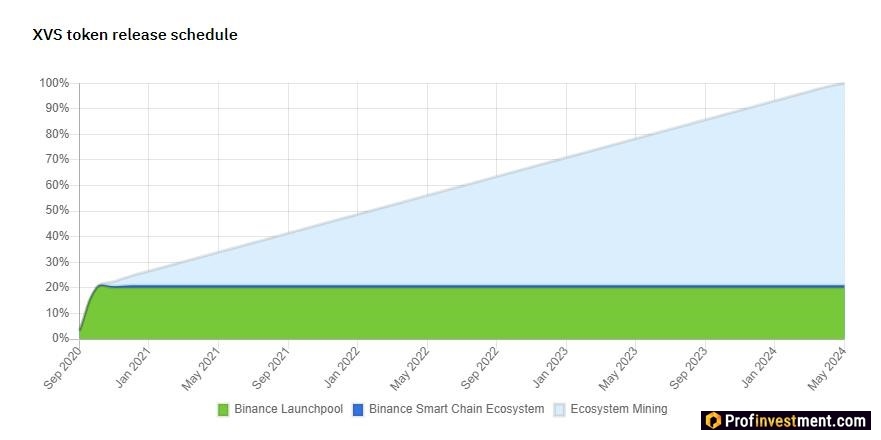

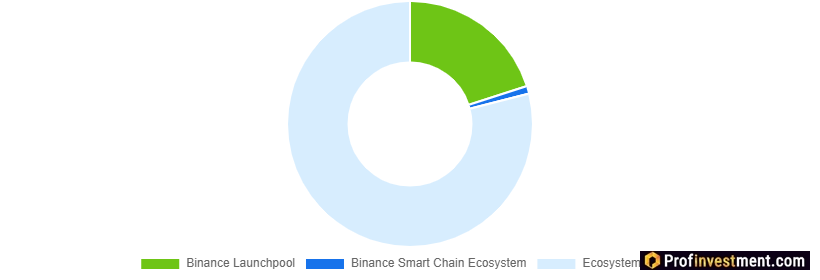

For pharming on Binance LaunchPool (for BNB, BUSD and SXP stakers) 6,000,000 XVS are allocated (20% of the total emission, which is 30,000,000 XVS). Another 1% (300,000) is earmarked for grants for the Binance blockchain ecosystem.

Everything else will be available exclusively if the protocol is active – thus, over the next four years, 23.7 million XVS will be distributed at a rate of 0.64 XVS per block (18 493 per day). 35% of daily rewards are distributed among borrowers, 35% among liquidity providers and 30% among VAI creators.

As soon as 10,000,000 XVS is mined, the token can be used to manage the platform. Until then, the Swipe Token (SXP) is considered the control token. SXP borrowers and suppliers will receive triple remuneration for the first 201,600 blocks.

Advantages and disadvantages

Pros:

- DeFi lending is the most sought after and lucrative area of decentralized finance.

- Possibility to receive XVS for various actions within the platform.

- Distribution of XVS between stakers on Binance LaunchPool.

- Collaboration with Binance cryptocurrency exchange and Swipe wallet, additional bonuses for SXP token providers.

Minuses

- Until the functionality is launched, it remains to trust the words of the developers.

- There are no blog entries, and no information about the team.

Perspectives

The protocol was developed by Swipe Wallet, which Binance acquired in early 2020. Binance executives said that the protocol should successfully eliminate existing pain points of DeFi projects on Ethereum (such as excessive network load and high transaction costs), since Venus operates on the Binance blockchain.